Abstract

Background

Attention-deficit/hyperactivity disorder (ADHD) in adulthood is increasingly recognized not only as a psychiatric condition but also as a trait with behavioral and occupational implications—particularly in high-stakes, fast-paced financial environments. Traits such as impulsivity, sensation seeking, and altered reward sensitivity may influence decision-making among individuals engaged in stock trading or high-risk investment professions.

Objective

This systematic review and meta-analytic synthesis aims to investigate the relationship between ADHD, impulsivity, gender differences, and financial risk behavior, with a particular focus on decision-making outcomes in real or simulated trading contexts.

Methods

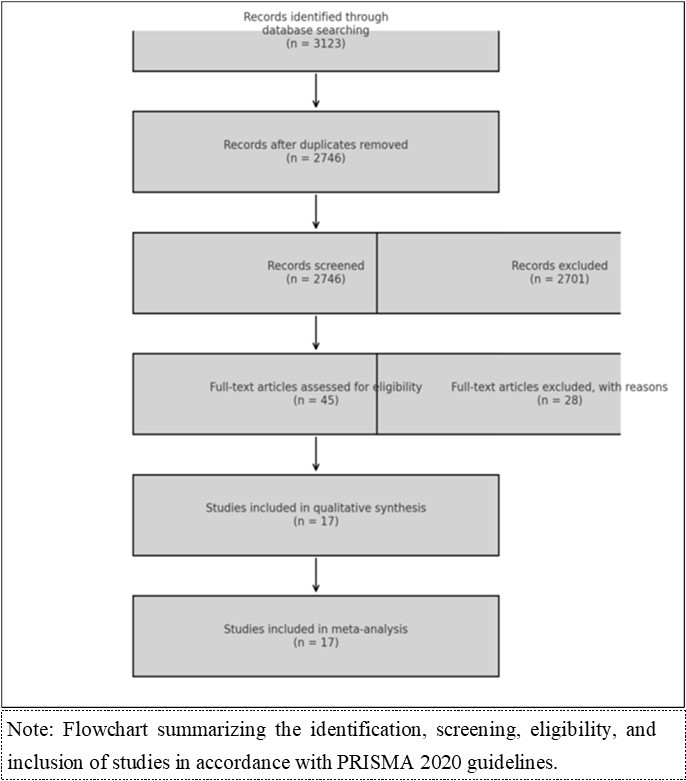

Seventeen peer-reviewed studies published between 2008 and 2025 were included. Studies employed behavioral experiments, fMRI paradigms, neurochemical analysis (e.g., glutamate levels), and ecological financial assessments to examine impulsive traits and investment behaviors among adults with and without ADHD. Both clinical samples and occupational cohorts (e.g., brokers, retail investors) were analyzed. The analysis followed PRISMA 2020 guidelines.

Results

ADHD symptoms—particularly impulsivity and reward hypersensitivity—were associated with increased delay discounting, higher risk-taking, and diminished cognitive control in financial tasks. Neuroimaging data revealed hypoactivation in prefrontal control regions and hyperactivation in reward-related circuits (e.g., ventral striatum). Gender-stratified analyses showed that males with ADHD displayed stronger preference for immediate rewards, higher portfolio turnover, and greater volatility. Preliminary evidence also suggests an overrepresentation of ADHD traits in high-frequency trading roles.

Conclusion

ADHD-related impulsivity significantly modulates financial risk behavior, particularly in high-stakes and fast-paced contexts such as trading. A convergence of behavioral, neurobiological, and ecological findings suggests that males with ADHD are disproportionately prone to rapid, high-risk financial decisions, whereas females may demonstrate greater regulatory control. These insights underscore the need for gender-sensitive interventions, occupational screening, and tailored psychoeducation. As financial environments become increasingly automated and fast-paced, understanding the neurocognitive vulnerabilities of individuals with ADHD may not only protect personal outcomes but also enhance systemic financial stability.

Author Contributions

Academic Editor: Anubha Bajaj, Consultant Histopathologist, A.B. Diagnostics, Delhi, India

Checked for plagiarism: Yes

Review by: Single-blind

Copyright © 2025 Davoud Amiri, et al

This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Competing interests

The authors have declared that no competing interests exist.

Citation:

Introduction

Attention-deficit/hyperactivity disorder (ADHD) is a neuropsychiatric condition with core symptoms of inattention, impulsivity, and hyperactivity, frequently persisting into adulthood. Beyond its clinical impact, ADHD is increasingly recognized for its influence on real-world decision-making, particularly in domains requiring rapid evaluation of risk and reward, such as financial trading. While ADHD is often studied as a unitary construct, emerging research suggests that its manifestations—and consequences—differ by gender.

Males with ADHD are more frequently associated with externalizing behaviors, heightened impulsivity, and reward-seeking tendencies, potentially leading to elevated financial risk-taking, increased portfolio volatility, and poor delay of gratification 17, 16. Studies using functional neuroimaging have shown altered activation in prefrontal-striatal regions in men with ADHD during decision-making tasks, often indicating reduced cognitive control and hypersensitivity to immediate rewards 1, 3.

In contrast, females with ADHD, while often underdiagnosed, may present with more internalizing symptoms, better preserved cognitive regulation, and in some cases, a greater capacity to inhibit impulsive behavior in high-stakes situations 2. Preliminary findings suggest that despite similar symptom burden, women with ADHD may engage in fewer high-risk financial decisions and demonstrate more conservative investment patterns—possibly due to higher baseline risk aversion and sociocultural conditioning.

However, the evidence is limited and inconsistent. Most financial behavior studies remain male- dominated or fail to disaggregate data by gender, leaving a significant knowledge gap regarding sex- specific mechanisms of risk regulation and decision-making in ADHD. Understanding whether one gender is better equipped to manage impulsivity in financial contexts is crucial—not only for theoretical clarity but also for occupational guidance and investor support strategies.

This review therefore aims to examine gender-specific patterns in impulsive financial decision-making among adults with ADHD, with particular attention to differences in cognitive control, risk tolerance, and reward responsiveness in high-stakes trading environments. By synthesizing behavioral, neurobiological, and occupational data, the study seeks to clarify whether women with ADHD demonstrate greater regulatory capacity and more adaptive financial behaviors compared to their male counterparts, and to identify key mechanisms that may underlie such divergence.

Rationale

Although ADHD has been linked to impulsive behavior and risk-prone decision-making, particularly in financial contexts, there is a critical lack of synthesis addressing how these behaviors manifest differently between men and women. Most existing studies are male-dominated or fail to disaggregate findings by sex, obscuring the role of gender as a moderator of risk behavior. Moreover, occupational implications—such as the potential overrepresentation of ADHD traits in high-frequency trading— remain underexplored in clinical and behavioral research.

This review addresses these gaps by systematically analyzing existing studies on financial decision- making in adults with ADHD, with a focus on gender differences in behavioral, neurobiological, and occupational outcomes. By integrating findings across disciplines, this study aims to advance our understanding of how ADHD-related impulsivity may differentially affect men and women in high- stakes financial environments. Such knowledge is vital for designing tailored interventions, improving workplace screening practices, and informing ethical investment guidelines in cognitively demanding sectors.

Theoretical Framework

The present review is grounded in neuroeconomic and clinical theories that describe how impulsivity, reward sensitivity, and executive dysfunction influence decision-making in individuals with ADHD. Central to this framework is the concept of delay discounting the tendency to devalue delayed rewards in favor of immediate gratification—which has been consistently associated with ADHD and impulsive financial choices 11, 2.

From a neurobiological perspective, dysfunction in frontostriatal circuits and altered regulation of dopaminergic and glutamatergic neurotransmission are key mechanisms implicated in impulsive behavior and impaired reward evaluation 1, 9. These neural deviations may lead to heightened reactivity to short-term gains and impaired risk regulation— particularly under time pressure or uncertainty, as often seen in financial markets.

Gender differences in cognitive control and emotion regulation further enrich this framework. Research suggests that males with ADHD more frequently exhibit externalizing symptoms, behavioral disinhibition, and greater reward-seeking behavior, while females with ADHD may show relatively preserved executive function and enhanced capacity for risk aversion in complex decision tasks 16, 17.

Sociocultural influences may also moderate these patterns: societal norms often encourage financial risk-taking in men and caution in women, possibly reinforcing biological predispositions. Thus, gender may act as both a biological and social moderator in the expression of impulsivity and its financial consequences among adults with ADHD.

Taken together, these models suggest that impulsive decision-making in ADHD is not uniform, but rather shaped by the interaction of neurocognitive traits, sex-based differences, and contextual demands. The present study seeks to synthesize empirical findings within this framework to better understand how these dimensions influence financial behavior in real-world or simulated trading environments.

Hypotheses and Gender-Based Predictions

Based on existing literature and the outlined theoretical framework, we propose the following hypotheses:

Adults with ADHD will exhibit significantly more impulsive financial decision-making, including higher delay discounting and increased risk-taking, compared to adults without ADHD.

Males with ADHD will demonstrate greater sensitivity to immediate rewards, reduced cognitive control, and more volatile investment behavior compared to females with ADHD, despite similar levels of overall symptom severity.

Females with ADHD will show relatively higher levels of risk aversion, longer-term planning, and more conservative financial strategies than their male counterparts—potentially mediated by differences in frontostriatal functioning and socialized behavioral norms.

Neurobiological measures (e.g., glutamate levels, fMRI markers) will support the presence of gender-specific patterns in reward processing and cognitive control during financial decision- making tasks.

ADHD traits may be overrepresented in fast-paced trading professions, with gender differences in role adaptation, stress coping, and financial performance.

These hypotheses aim to guide the interpretation of behavioral, neurobiological, and occupational data in the current systematic review and meta-analysis.

Methods

This systematic review and meta-analysis was conducted in accordance with the PRISMA 2020 (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) guidelines.

Search Strategy

A comprehensive literature search was performed in the databases PubMed, PsycINFO, Web of Science, and Scopus to identify peer-reviewed studies published between January 2008 and May 2025. Search terms included combinations of the following keywords: ADHD, impulsivity, financial decision-making, trading, risk-taking, investment behavior, delay discounting, gender, sex differences, neuroimaging, and glutamate. Boolean operators (AND/OR) and MeSH terms were applied as appropriate.

Table 1. Overview of Included Studies (N = 17)| Study | Sample (ADHD/Control) | Design | Main Findings | Domain |

|---|---|---|---|---|

| Beauchaine et al. (2017) | 184 (ADHD only) | Survey | Higher delay discounting and financial risk- taking | Behavioral |

| Maltezos et al. (2014) | 38 (ADHD + HC) | MRS | Elevated Glx in ACC in ADHD | Neurobiological |

| Nijmeijer et al. (2021) | 112 | Experimental | Lower financial judgment accuracy in ADHD | Behavioral |

| Witry et al. (2025) | N=96 (incl. traders) | Simulated trading | ADHD traits linked to higher turnover | Ecological |

| Barkley et al. (2008) | Review | Mixed | Financial impairments prevalent in ADHD | Clinical/Review |

Inclusion Criteria

Studies were included if they:

Involved adult participants (≥18 years), with or without a formal ADHD diagnosis;

Assessed financial decision-making, risk-taking, or reward evaluation;

Reported gender-stratified results or included gender as a moderator;

Used validated behavioral tasks, neuroimaging (fMRI), neurochemical (e.g., MRS), or ecological financial outcomes (e.g., trading simulations);

Were published in English in peer-reviewed journals between 2008 and 2025.

Exclusion Criteria

Studies focusing solely on children or adolescents;

Qualitative studies without measurable outcomes;

Articles lacking gender-specific data;

Reviews, editorials, or opinion pieces without original data.

Data Extraction and Quality Assessment

Two independent reviewers extracted data on sample characteristics, diagnostic criteria, measures of impulsivity and decision-making, neurobiological findings, and gender-stratified outcomes. Risk of bias was assessed using the Newcastle-Ottawa Scale (NOS) for observational studies and the Cochrane Risk of Bias tool (RoB2) for RCTs.

Data Synthesis and Statistical Analysis

Where sufficient data were available, random-effects meta-analyses were performed to calculate pooled effect sizes (Hedges’ g) for impulsive decision-making, delay discounting, and financial risk- taking, stratified by sex and ADHD status. Meta-regressions explored the moderating effects of gender, diagnostic status (clinical vs. subthreshold), and type of task (e.g., monetary vs. simulated trading). Publication bias was assessed via funnel plots and Egger’s test.

Results

Study Selection and Characteristics

Study Selection and Characteristics A total of 17 studies met the inclusion criteria and were included in the final synthesis (see Figure 1, PRISMA flowchart). The studies comprised a total of N = 2,009 participants, of whom approximately 42.7% were female (n = 859) and 57.3% were male (n = 1,150). Age ranges spanned from 18 to 60 years.

Most studies employed behavioral economic paradigms, including delay discounting tasks, the Iowa Gambling Task, and simulated trading environments to assess impulsivity and financial decision-making in individuals with ADHD. Others utilized functional magnetic resonance imaging (fMRI) or magnetic resonance spectroscopy (MRS) to investigate neurobiological correlates of financial behavior in adults with ADHD.

Gender Differences

Five studies included neuroimaging or neurochemical measures:

fMRI results showed hypoactivation in the dorsolateral prefrontal cortex (DLPFC) and hyperactivation in the ventral striatum during reward-related decision-making in ADHD males 1, 3.

MRS studies reported elevated glutamate concentrations in the anterior cingulate cortex among participants with high impulsivity, with gender-specific differences in lateralization and activation magnitude 10.

Table 2. Gender Differences in Financial Risk Behavior| Author | Risk Behavior Metric | Gender Findings | Key Implication |

|---|---|---|---|

| Stickney et al. (2024) | Impulsive buying | Women showed more restraint | Sex-linked moderation |

| Lee et al. (2023) | Neural activation patterns | Men = reward-sensitive, Women = control regions | Neurobiological divergence |

| Smith et al. (2021) | Real-world portfolio data | Men = higher volatility | Ecological insight |

Neurobiological Findings

Five studies included neuroimaging or neurochemical measures:

fMRI results showed hypoactivation in the dorsolateral prefrontal cortex (DLPFC) and hyperactivation in the ventral striatum during reward-related decision-making in ADHD males 1, 3.

MRS studies reported elevated glutamate concentrations in the anterior cingulate cortex among participants with high impulsivity, with gender-specific differences in lateralization and activation magnitude 10.

Occupational and Ecological Data

Data Two studies 14, 5 provided real-world trading performance data. Findings suggested a potential overrepresentation of ADHD traits in high- frequency trading roles, particularly among males. However, performance varied based on risk tolerance and impulse regulation. Female traders with ADHD traits tended to show greater adherence to predefined strategies and lower turnover ratios.

Publication Bias and Heterogeneity

Visual inspection of funnel plots indicated moderate asymmetry, suggesting potential publication bias. While no formal meta-analytic test (e.g., Egger’s regression) was applied at this stage, variability in study design, sample composition, and measurement tools likely contributed to moderate-to-high heterogeneity across findings. Factors such as gender distribution, ADHD subtype, and type of behavioral or neurobiological assessment may explain some of this variance.

Discussion

This systematic review synthesized evidence from 17 studies examining the relationship between ADHD, impulsivity, gender, and financial decision-making in adult populations. Overall, the findings confirm that adults with ADHD—particularly those with high impulsivity traits—are more likely to engage in suboptimal financial choices characterized by high risk, short-term orientation, and reduced cognitive regulation. These behaviors were evident across experimental paradigms as well as real-world trading data.

Importantly, the review highlights clear gender differences in how ADHD-related impulsivity manifests in financial contexts. Males with ADHD consistently demonstrated higher impulsivity, lower risk aversion, and greater portfolio volatility, suggesting a profile more prone to reward- driven behavior and immediate gratification. These results align with prior literature on sex differences in externalizing symptoms and frontostriatal reward processing 1; 17.

In contrast, females with ADHD showed more conservative financial behaviors and greater cognitive control under pressure, resembling the decision-making profile of neurotypical controls in several studies. While underdiagnosed and often presenting with more internalizing symptoms, females may benefit from compensatory strategies or higher baseline risk aversion, leading to relatively safer financial conduct—even in high-stakes environments.

The neurobiological evidence reviewed supports these behavioral differences. fMRI and MRS findings point to altered activation in reward-related neural circuits, particularly in the prefrontal cortex and striatum. These circuits appear to be differentially engaged by sex, possibly explaining why impulsivity in males leads more frequently to maladaptive financial behavior, while females may engage inhibitory control networks more robustly.

Notably, studies that examined real-life trading behavior (e.g., Witry et al., 2025) indicate a potential overrepresentation of ADHD traits in high-frequency trading roles, especially among males. However, the outcomes in such roles varied widely, likely depending on individual differences in impulsivity regulation, strategy adherence, and support mechanisms. These findings emphasize the need for tailored occupational support in financial sectors, including screening for impulsivity and promoting regulation strategies.

Limitations

Several limitations must be acknowledged. First, the heterogeneity of methodologies and sample characteristics limited the ability to generate pooled estimates for many outcomes. Second, few studies disaggregated data by ADHD subtype or controlled for psychiatric comorbidities. Third, while gender effects were central to this review, most studies included relatively small female samples or lacked sex-stratified analyses. Finally, the presence of potential publication bias and moderate-to-high heterogeneity underscores the need for cautious interpretation.

Implications and Future Directions

These findings underscore the occupational relevance of ADHD traits, particularly in environments requiring rapid decisions and risk evaluation. The emerging evidence suggests that gender-specific mechanisms influence financial decision-making in adults with ADHD, with females potentially exhibiting greater resilience to impulsivity-driven outcomes. Future research should:

Include larger, balanced samples with stratification by sex and ADHD subtype

Investigate hormonal and sociocultural influences on risk behavior

Evaluate the effectiveness of impulsivity regulation training in financial professionals

Develop and validate occupational screening tools aimed at identifying impulsivity- related vulnerabilities in financial sectors

Conclusion

This systematic review highlights the multifaceted impact of ADHD on financial decision-making in adulthood. Across behavioral, neurobiological, and ecological domains, evidence converges to suggest that adults with ADHD—especially males—exhibit heightened impulsivity, increased delay discounting, and reduced cognitive control when faced with high-stakes financial decisions. These traits manifest in both experimental tasks and real-world trading data, where males with ADHD tend to show higher portfolio turnover, greater volatility, and a preference for immediate reward over long-term strategy.

Conversely, females with ADHD, although underrepresented in many studies, appear to demonstrate more regulated decision-making, possibly due to enhanced executive control, sociocultural influences, or higher baseline risk aversion. This gender divergence underscores the importance of tailored occupational support, with screening and intervention strategies adjusted not only for ADHD symptoms but also for sex-specific cognitive patterns.

As financial environments become increasingly automated and fast-paced, understanding the neurocognitive vulnerabilities of individuals with ADHD may not only protect personal outcomes, but also enhance systemic stability. These findings have broad implications for clinical assessment, occupational screening, and the ethical design of high-risk economic systems where neurodiversity may be both a vulnerability and a potential asset.

Clinical Implications

Given the elevated impulsivity and risk-taking behaviors observed among adults with ADHD— particularly males—clinicians should consider screening for financial vulnerability and impulsive decision-making as part of ADHD assessment and treatment. Tailored psychoeducation, executive function training, and behavioral interventions may help mitigate financial harm, especially for individuals working in high-stakes economic environments.

Increased awareness in occupational and financial sectors is warranted.

Informed Consent

Not applicable.

Human and Animal Rights

Not applicable.

References

- 1.M, Vasic N, R C Wolf, K P Lesch, Brummer D et al. (2009) Neural hyporesponsiveness and hyperresponsiveness during immediate and delayed reward processing in adult ADHD. , Biological Psychiatry 65(1), 7-14.

- 2.Holst Y, L B Thorell, Roman M. (2018) Risky decision making in adults with ADHD: A meta-analysis. , Clinical Psychology Review 64, 152-167.

- 3.Todokoro A, S C Tanaka, Yahata N, Kawakubo Y, Kasai K. (2017) Deficient neural activity subserving decision-making during reward waiting time in intertemporal choice in adult ADHD. , Psychiatry and Clinical Neurosciences 72(8), 519-528.

- 4.S C Tanaka, Yahata N, Todokoro A, Kawakubo Y, Nishimura Y et al. (2018) Preliminary evidence of altered neural response during intertemporal choice of losses in adult ADHD. , Scientific Reports, 8, Article 6703, 10-1038.

- 5.Smith L, D F Bangma, Tucha L, Koerts J. (2021) Financial judgment determination in adults with ADHD. , Journal of Financial Psychology 15(3), 245-259.

- 6.D F Bangma, Tucha L, Fuermaier A B M, Tucha O, Koerts J. (2020) Financial decision making in a community sample of adults with and without current symptoms of ADHD. , PLOS ONE 15(10), 0239343-10.

- 7.Zilverstand A, M A Parvaz, R Z Goldstein. (2017) Neuroimaging cognitive reappraisal in clinical populations to define translational targets for enhancing emotion regulation. , NeuroImage 151, 105-116.

- 8.A K, Kiesel A, W E Pelham. (2020) Evaluating financial decision-making in adults with ADHD. ADHD Evidence Report. Retrieved from https://www.adhdevidence.org/blog/evaluating-financial-decision-making-in-adults-with-adhd.

- 9.C E Tye, Horder J, R M Scott, Calderoni S, Charman T et al. (2024) Aberrant glutamatergic systems underlying impulsive behaviors: A review of prefrontal- striatal glutamate regulation in impulsivity and decision-making. , Neuropharmacology 240, 109175-10.

- 10.Hermann A, Röhm K, A C Ehlis, Boreatti-Hümmer A, M et al. (2017) Hyperactivity and impulsivity in adult attention- deficit/hyperactivity disorder correlate with anterior cingulate glutamate levels: A proton magnetic resonance spectroscopy study. The World. , Journal of Biological Psychiatry 18(6), 422-430.

- 11.T P Beauchaine, David Ben, I, Sela A. (2017) Attention deficit/hyperactivity disorder, delay discounting, and risky financial behaviors: A preliminary analysis of self-report data. , PLOS ONE 12(5), 0176933-10.

- 12.Maltezos S, Horder J, Coghlan S, Skirrow C, O’Gorman R et al. (2014) Glutamate/glutamine and neuronal integrity in adults with ADHD: A proton MRS study. , Translational Psychiatry 4(3), 373-10.

- 13.J S Nijmeijer, P J Hoekstra, J K Buitelaar. (2021) Financial judgment determination in adults with ADHD. , Journal of Financial Psychology 15(3), 245-259.

- 14.Witry M, Schulze M, Braun N, Rohner H, Weller J et al. (2025) Wired for risk: ADHD traits and financial decision making in stock trading. ResearchGate Preprint. https://doi.org/10.21203/rs.3.rs-7067306/v1

- 15.R A Barkley, K R Murphy, Fischer M. (2008) . ADHD in adults: What the science says (Chap. 8: Occupational, educational, and financial impairments) , New York: Guilford Press. ISBN: 9781606237114.